Everybody wants to call their startup or investment “FinTech” and it led me to start thinking about what a FinTech company is in the first place. Searching Google for some definitions led me to some dated or unsatisfying responses.

So, I took a stab at defining what might be considered a FinTech, company. There is plenty of fleshing out of this model that still needs to be done but I’d like to share version 0.1 (beta!) with the world.

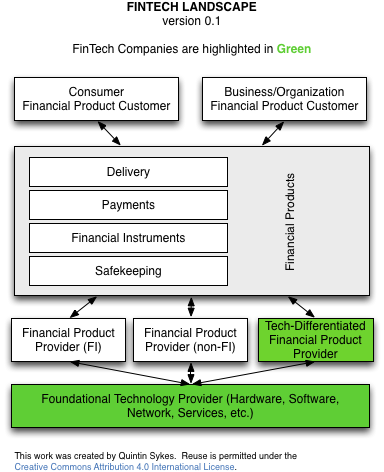

A Model for Defining FinTech

Starting in the middle of the diagram, Financial Products include not only the financial instruments themselves, but also delivery, payments, and safekeeping products associated with those instruments.

Moving to the top of the diagram, customers (consumers or businesses/organizations) generally acquire Financial Products through one of three types of financial product providers (“Providers”):

- Financial institutions offering traditional products such as deposits, loans, investments/insurance, etc.

- Non-financial institutions offering products such as payday lending and commercial finance

- Non-financial institutions offering products using differentiated technology such as P2P loan exchanges or mobile payments

I initially only had (1) and (2) above but quickly realized I needed to distinguish between historic non-bank lenders and recent entrants such as Lending Club, for example, so (3) was created. Conveniently, (3) also provides a home for Providers that go straight to the customer for Financial Products that aren’t bundled with a financial instrument (Square, for example).

At the bottom of the stack (but critical), Foundational Technology Providers offer the underlying hardware, software, network, services, etc. that enable the delivery of Financial Products by any of the three types of Providers.

So we’ve arrived at the definition of a FinTech company. I consider companies offering Financial Products using differentiated technology (Provider type 3 above) along with the Foundational Technology Providers to be companies in the FinTech space.

Feedback is welcome and appreciated–hit me in the comments below or on Twitter. I know there is some smoother verbiage I can apply here and the graphic can be better. The topic’s been eating at me for a couple of weeks so I wanted to get my thoughts out there. I’m also doing some research over the next few weeks that will allow me to drill down on each of the components of the model to see if it holds up and will share more soon.